What is accrued interest?

This is Interest earned but not received (realized). Interest will usually accrue between last interest payment and the next. The borrower of a loan pays its principal plus the interest earned up to the last installment.

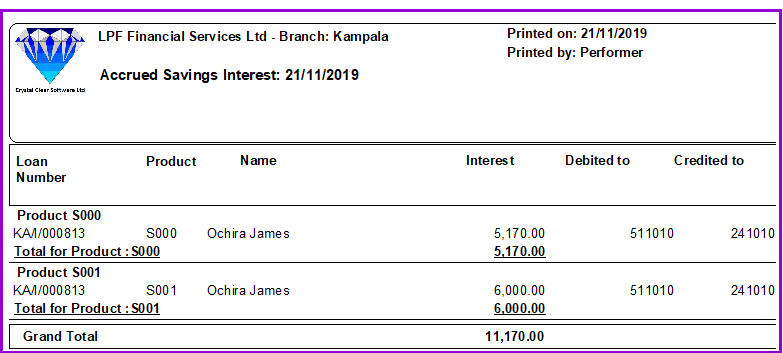

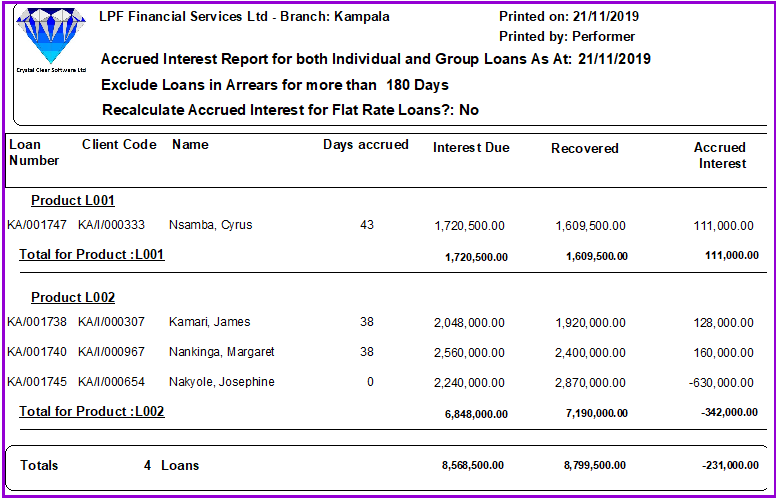

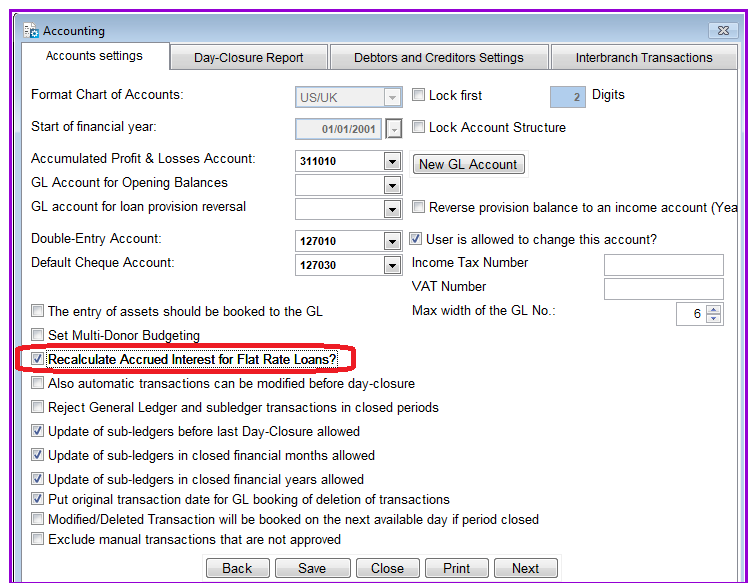

Accrued interest is normally calculated at the end of the month but you may decide to calculate it as often as you want. The only limitation is that you should not calculate it for dates before the last calculation for instance if the last interest calculation date was "30 January 2020", you can only calculate accrued interest after this date. And if you decide to do it at a certain frequency it is better that you stick to it.The principal idea behind this module is that it calculates the accrued interest, checks the balance of the affected accounts, and then updates the accounts to match the calculated interest.

How to calculate Accrued Interest

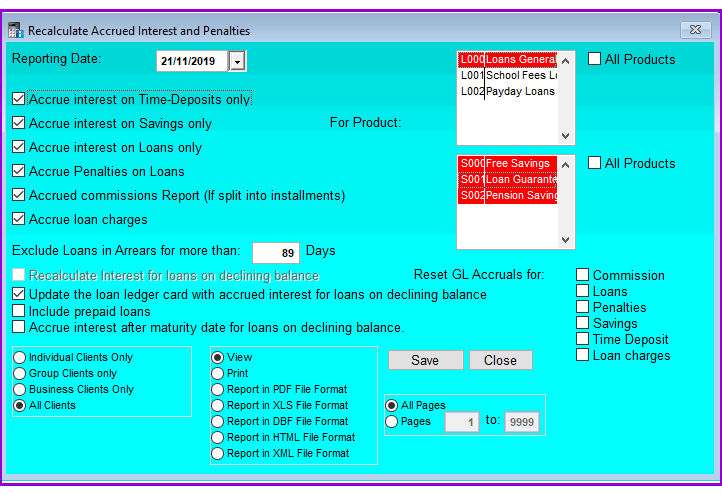

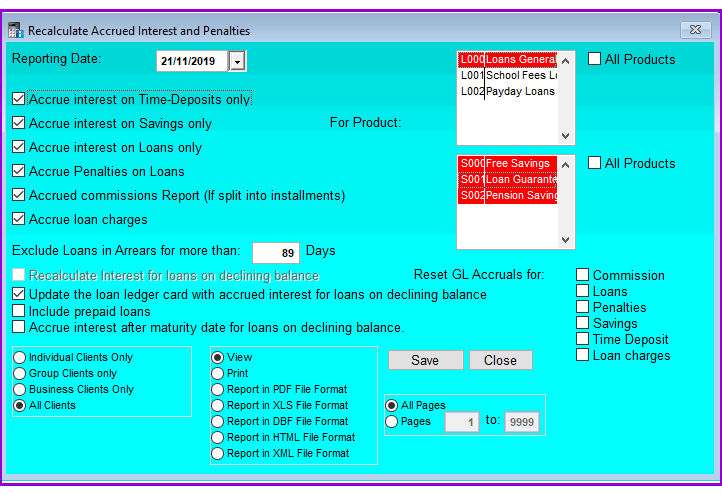

To calculate accrued interest you go to Accounts/Calculate Accrued interest and the following screen appears:

Update the loan ledger card with accrued interest for loans on declining balance: When this option is checked, LPF not only books the accrued interest to the General Ledger but will also add another installment of accrued interest to the client's loan ledger card. This is normally at the end of the month. This enables LPF user to show the client his/her loan ledger card reflecting the up-to-date interest amount to pay at the repayment date especially for loans with interest calculation in days.

Include prepaid loans: When this option is ticked, prepaid loans that normally don't show up, will also appear with days and the interest in arrears indicated in negatives covering the period of the prepaid interest from the date of prepayment upto current or reporting date.

Click on the close button to exit.

The Nº 1 Software for Microfinance